Current situation and market analysis on development of polypropylene industry

Source:www.cheminfo.gov.cn 2012-04-16

Under the global financial crisis, China first broke through the predicament and became the engine of economy recovery of the world. The domestic petrochemical industry also went into the quick recovery period, wherein, the demand of synthetic resin saw a quick growth, China is the biggest synthetic resin import country in the world, in 2010 the consumption of polypropylene grain material is 13.6 million tons, the capacity in domestic is 9.66 million tons, in the next few years with the rapid growth of capacity in domestic, China shall become the biggest polypropylene production power in the world ahead of USA. Nevertheless the product structure layout of China’s polypropylene industry is not reasonable, and does not form the economy of scale, the product cost is high, which is in the disadvantage position when competing with international large petrochemical enterprise. Especially in recent years with the rapid rising of petrochemical enterprise of Middle East, a large number of plants of million tons capacity are put into production, their low cost advantage strongly impacts the polypropylene market. With the great capacity expansion in domestic and the entry of large international demand shall occur, in the future the price competition is inevitable.

1 The Current situation and trend of polypropylene development in the world

In 2008, the financial crisis of USA promptly impacted the global financial market and quickly spread to real economy from virtual economy. Under the impact of USA financial crisis, the global financial market furiously fluctuated, every stock market in the world was hit hard, and the chemical industry also suffered. From the second half year of 2008 the economy of main economy communities rapidly dropped, and the economic downturn was very apparent. The development of chemical industry is slow, and there is no escape for polypropylene product. According to statistics, in 2008 the consumption of polypropylene in the world was 45.5MMT with a reduction of 1.4MMT when compared with that in 2007. In 2009 and 2010, each main economic community in the world successively pushed out a series of economic stimulating policies to boost the economic recovery. The global trading and industrial production appeared the trend of economic rebound. Especially China’s economy was quickly strengthened which is just like to give an injection of stimulant to the whole world. Accordingly the consumption of polypropylene in the world was increased to 55 MMT in 2010 with an increase of 20% in comparison with 2008.

1.1 Market supply/demand analysis and capacity expansion of polypropylene in the world

The supply/demand analysis of polypropylene in the world (2008-2012) is shown in Fig. 1. In 2008 the total capacity of polypropylene in the world was 48MMT, while the demand quantity was 45.2 MMT. Table 1 is the summary of capacity expansion of polypropylene plants in the whole world. With the successive put-into-production of newly added capacity, it is predicted that in 2012 the total capacity of polypropylene shall be increased by 11.9% and can reach 71 MMT, the compound growth rate of 2008-2012 is high and the increment is 23 MMT. With the increasing of demand it is predicted that the total demand quantity of polypropylene in the world in 2012 shall be 59 MMT, the compound growth rate of 2008-2012 shall be 5.7%, and the increment shall be 14 MMT.

.jpg)

Table 1: Summary of capacity expansion of polypropylene in the world

|

Region

|

Country

|

Enterprise

|

Increment capacity/ten thousand tons

|

The year for put-into-production

|

|

Middle East

|

United Arab Emirates

|

|

80

|

2010

|

|

Middle East

|

Iran

|

|

30

|

2010

|

|

Europe

|

Sweden

|

North Europe Chemical Industry Borealis

|

80

|

2010

|

|

South Asia and South East Asia

|

India

|

Hindustan Petroleum Corporation Limited

|

60

|

2010

|

|

South Asia and South East Asia

|

Singapore

|

Singapore Petrochemical Complex

|

45

|

2011

|

|

Middle East

|

Saudi Arabia

|

Qatar Petroleum & Honam Petrochemical

|

70

|

2011

|

|

South Asia and South East Asia

|

Indonesia

|

|

25

|

2011

|

|

South America

|

Venezuela

|

|

45

|

2011

|

|

Europe

|

Portugal

|

|

57

|

2011

|

|

Middle East

|

Saudi Arabia

|

|

55

|

2012

|

|

East Europe

|

Russia

|

|

20

|

2012

|

|

Middle East

|

Saudi Arabia

|

Saudi Arabian Oil Company and Dow Chemical

|

70

|

2012

|

|

South Asia and South East Asia

|

Russia

|

Oil and Natural Gas Corporation

|

50

|

2012

|

|

Middle East

|

India

|

|

36

|

2012

|

|

Middle and North America and Caribbean Sea

|

Iran

|

LyondellBasell, Lurgi, Trinidad and Tobago government

|

25

|

2012

|

|

South Asia and South East Asia

|

Trinidad and Tobago

|

Essar and Gujarat Petrochemical

|

49

|

2012

|

|

Total up

|

India

|

|

90

|

2012

|

|

|

|

|

887

|

|

According to prompt expansion of global polypropylene capacity of 2008-2012, it can be seen that the total expanded capacity shall apparently exceed the increment of demand, the pressure of surplus capacity is obvious. Therefore, it is self-evident that the production rate shall be dropped to about 80% unless many plants are shutdown.

In 2008-2012, the newly added capacity shall mainly aggregate in Middle East, China, India and South-East Asia (table 2). During this period the newly added capacity of Middle East shall be 6.3MMT accounting for 36% of total capacity increment of the world. Wherein, Saudi Arabia shall be the main capacity expansion country. After this capacity expansion, Middle East shall become the main polypropylene export region in the world. In addition, due to increase of sales quantity in domestic, China and India shall also be the main region of capacity expansion during this period, nevertheless, the supply gap in domestic is also fairly great, China and India shall continually become the main drive for consumption and import of polypropylene in the world.

Table 2; The statistics of capacity expansion of each main region in the world in 2008-2013

|

Region

|

Newly added capacity/ten thousand tons

|

|

China

|

580

|

|

Middle East/Africa

|

498

|

|

India

|

329

|

|

Middle/East Europe

|

169

|

|

Middle/South America

|

117

|

|

Asia and Pacific Region

|

45

|

|

West Europe

|

16

|

|

Japan

|

-7.8

|

|

North America

|

-26.3

|

|

Total up

|

2060.9

|

According to statistics in recent years it can be seen that, the production capacity of polypropylene in the world shall be increased to nearly 72.6MMT/a in 2013 from 52MMT/a in 2008. The capacity is greatly expanded but provisionally the demand quantity is not closely followed, in 2010 the production rate of polypropylene plant is basically be 85% more or less, since the economy is not yet fully recovered while the capacity is promptly expanded, it is predicted that the production rate of polypropylene in 2011 shall be dropped to 80% more or less. As to manufacturer with high cost, according to historical experience, when the production rate is lower than 85% the business shall go bankrupt. Therefore it can be predicted that, the shutdown of some plants is inevitable, in the future some projects shall be postponed or cancelled.

1.2 Forecast of consumption analysis and consumption structure of polypropylene in the world

At present the main polypropylene trading region in the world is mainly in Asia, North America and West Europe. According to trading trend in recent years, the proportion of Asia region in the total trading quantity of the world shows the gradual rise trend, while the trading quantity of North America exhibits the trend of gradual drop. Asia has become the main production and consumption region, and become the competition focus of polypropylene in the world, the surplus capacity of polypropylene in the world shall incur great pressure to polypropylene industry of China.

As to consumption structure, the main usage of polypropylene is mainly to produce the draw wire, injection mould and membrane product (Fig. 2). In addition, the proportion of fiber and pipe material in the consumption structure of polypropylene is also fairly great.

According to Fig. 3, the consumption structure of polypropylene of the world in 2012 is not substantially changed in comparison with that in 2009, the proportion of draw wire product shall be slightly dropped, and the demand increment of injection mould product and fiber is biggest, which is determined by the performance advantage of polypropylene. The development of global economy boosts the development of demand of polypropylene fiber and especially the demand of high level fiber, furthermore, the polypropylene membrane also has the fairly great market demand.

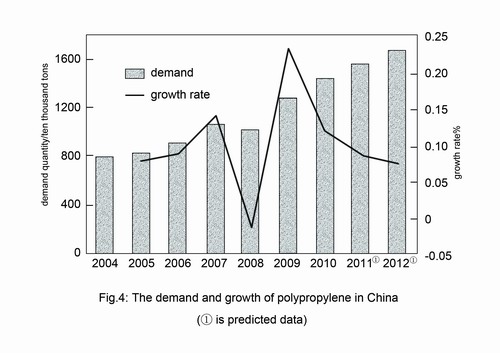

2 Current situation and trend of polypropylene in domestic

In recent years China’s economic growth is rapid, and the demand of market to various chemical feedstock is increasing, and thus the consumption of polypropylene is greatly increased. China is the biggest polypropylene consumption country in the world, in Fig. 4 it can be seen that in 2004 China’s polypropylene demand exceeds 7.9MMT, in 2010 it is 13.6MMT. At present, China’s polypropylene demand is also increasing. Since 2004 the annual mean growth rate is always about 14% until 2008, when global financial crisis occurred, China’s polypropylene demand was impacted and started to drop. Nevertheless, China’s economic environment is promptly rebounded due to various economic stimulating policies of each country. In 2009 China’s polypropylene demand was quickly recovered from crisis, and may continually to maintain fairly high growth rate in the next few years. It is predicted that in 2012 China’s polypropylene demand shall exceed 16MMT.

There are nearly 50 polypropylene grain manufacturers and hundreds of polypropylene powder manufacturers in China. Wherein, the capacity of large grain manufacturers accounts for nearly 86% of the capacity of the whole industry circle, these manufacturers are mainly PetroChina and Sinopec companies. When the capacity of these large polypropylene grain manufacturers is quickly expanded, various small polypropylene powder manufacturers can only maintain the production and are even forced to reduce the capacity.

2.1 Supply/demand analysis and capacity expansion of polypropylene market in domestic

2.1.1 Analysis and prediction of supply/demand of polypropylene market in domestic

After the outburst of USA financial crisis in 2008, the demand growth of polypropylene in the world is slowed down. Nevertheless Chinese government pushed out the 4 trillion RMB investment policy, and took appropriate easy money policy and positive financial policies, thus China’s economy is stabilized and strengthened. In the next few years the demand of polypropylene of domestic market shall be increased in some extent, but the growth rate shall be slowed down due to the following causes: the global economy is slowed down, in the future the crude oil price shall continually rise and this shall impact the demand and price of import/export cargo; the impact from RMB rise and domestic inflation of China.

In the past, the annual mean growth rate of polypropylene is about 12%, in the next few years (after 2008) the annual mean growth rate is predicted as about 10%. Although it is lower than that in the past, it is also in the leading position in the world. The trend of supply/demand relation is the main evidence to forecast the market. Fig. 5 is the supply/demand relation for polypropylene in China market.

In 2010 China's polypropylene import quantity is about 4MMT and the self provision rate is 70%. In 2010-2012 China shall have several million tons of newly added capacity (put into production), therefore in the next few years the import quantity shall be gradually dropped. It is predicted that in 2010-2012, the annual mean growth rate of China’s polypropylene capacity shall be 15.5%, in 2012 the grain polypropylene capacity of China shall be over 15MMT, and is four folds of that in 2002.

In the first half year of 2008 the market price of polypropylene in domestic rapidly rose, nevertheless impacted by global economic downturn, in the second half year of 2008 the market price of polypropylene greatly dropped, in 2009 the market price of polypropylene quickly rebounded due to recovery of domestic demand and rebuilding of social inventory. Nevertheless even the domestic price continues with the rebound in the next few years, it shall also be impacted by the factors of: the competition is severe due to prompt growth of capacity in domestic, the overseas demand is in downturn due to impact of financial crisis, the pressure of RMB appreciation shall lower the import cost of crude oil and polypropylene, etc. These factors shall incur the drop of market price in domestic. With the coming of high oil price times, polypropylene price has leaped into a new position, furthermore, the impact of domestic inflation shall also boost the price, in the future the price shall fluctuate at high level.

2.1.2 Capacity expansion and capacity distribution of polypropylene in domestic

From the middle of 1990s, China's polypropylene production and consumption entered the fast development period. China has become the country with fastest growth of polypropylene consumption in the world. According to table 3, with the rising of domestic demand and the gradual capacity expansion of petrochemical enterprise, in 2008-2012 the polypropylene plants of 9MMT capacity were or will be put into production. In the newly built plants, except for a few plants (200000T/a), most of them exceed 300,000t/a reaching the international scale, thus the risk resistance capability is greatly improved. After the above plants are put into production on time, the capacity of Sinopec shall exceed the Basell and rank first in the world, PetroChina shall move up to No.5 in the world. In addition, the crude oil resource in Middle East is abundant with cheap cost; there shall also be large scale capacity expansion in this region. After 2010 nearly 9MMT capacity of Middle East shall be successively put into production. The vast polypropylene manufacturers of Middle East shall aim at China, the market with fastest economic development in the world, no doubt the competition in the next few years will be extreme.

Table 3: Distribution of grain polypropylene manufacturers (with capacity expansion) in China in 2005-2012; unit: ten thousand tons

|

Region

|

2007

|

2008

|

2010

|

2012

|

|

North East China

|

|

|||

|

Daqing Refining & Chemical

|

30

|

30

|

30

|

60

|

|

Daqing Petrochemical

|

10

|

10

|

10

|

10

|

|

Jinxi Petrochemical

|

0

|

0

|

15

|

15

|

|

Dalian Petrochemical

|

32

|

32

|

32

|

32

|

|

Dalian Xitai

|

10

|

10

|

10

|

10

|

|

Dalian Fujia

|

0

|

0

|

0

|

30

|

|

Fushun Petrochemical

|

9

|

9

|

9

|

39

|

|

Panjin Ethylene

|

5

|

5

|

30

|

30

|

|

Liaoyang Petrochemical

|

4.3

|

4.3

|

4.3

|

4.3

|

|

Qianguo Petrochemical

|

4

|

4

|

4

|

4

|

|

North China

|

|

|||

|

Yanshan Petrochemical

|

44

|

44

|

44

|

44

|

|

North China Petrochemical

|

10

|

10

|

10

|

10

|

|

Qingdao Refining and Chemical

|

0

|

20

|

20

|

20

|

|

Jinan Refinery

|

12

|

12

|

12

|

12

|

|

Qilu Petrochemical

|

7

|

7

|

7

|

7

|

|

Hebei Haiwei

|

0

|

0

|

0

|

60

|

|

Tianjin Complex

|

6

|

6

|

6

|

6

|

|

Zhongsha Petrochemical

|

0

|

0

|

45

|

45

|

|

Datang International

|

0

|

0

|

0

|

46

|

|

Baotou Shenhua

|

0

|

0

|

30

|

30

|

|

Zhenhai Refining and Chemical

|

0

|

0

|

10

|

10

|

|

Shaoxing Sanyuan

|

20

|

20

|

20

|

50

|

|

Anhui Huaihua

|

0

|

0

|

0

|

49

|

|

South China

|

|

|||

|

Fujian Complex

|

0

|

0

|

40

|

40

|

|

Guanxi Beihai

|

0

|

0

|

0

|

20

|

|

Fujian Refining and Chemical

|

12

|

12

|

12

|

12

|

|

Zhonghai Shell

|

24

|

24

|

28

|

28

|

|

Maoming Petrochemical

|

47

|

47

|

47

|

47

|

|

Guangzhou Petrochemical

|

17

|

17

|

17

|

17

|

|

Zhonghua Quanzhou

|

0

|

0

|

0

|

20

|

|

Zhanjiang Dongxing

|

0

|

0

|

14

|

14

|

|

Guangxi Petrochemical

|

0

|

0

|

20

|

20

|

|

Hainan Refining and Chemical

|

20

|

20

|

20

|

20

|

|

North West China

|

|

|||

|

Lanzhou Petrochemical

|

34

|

34

|

34

|

34

|

|

Langang Petrochemical

|

11

|

11

|

11

|

11

|

|

Ningxia Shenhua

|

0

|

0

|

0

|

150

|

|

Yan’an Refining and Chemical

|

10

|

10

|

30

|

30

|

|

Qingyang Petrochemical

|

0

|

0

|

10

|

10

|

|

Dusanzi Petrochemical

|

14

|

14

|

69

|

69

|

|

South West China

|

|

|||

|

Chengdu Ethylene

|

0

|

0

|

0

|

45

|

|

Total up

|

578.3

|

648.3

|

966.3

|

1550.3

|

In 2010 there were over 50 grain polypropylene manufacturers in China, the mean annual capacity has exceeded 200,000t. Except for four manufacturers which are invested by local governments, the other manufacturers are mainly companies of PetroChina, Sinopec and some joint ventures, some are of private enterprises. The capacity under PetroChina and Sinopec accounts for 75% of total capacity of China.

2.2 Consumption analysis and consumption structure forecast of polypropylene in domestic

2.2.1 Consumption quantity of polypropylene in domestic

At present the polypropylene capacity in domestic is mainly concentrated in East China and South China, while the demand of polypropylene is mainly concentrated in three regions as East China, North China and South China. Table 4 is the distribution of production and consumption of polypropylene.

Table 4: Output and consumption quantity of polypropylene for each region of China in 2009

|

Region

|

Output

|

Consumption quantity

|

|

East China

|

34.0%

|

40.1%

|

|

South China

|

20.4%

|

19.7%

|

|

North China

|

20.0%

|

23.6%

|

|

North East China

|

14.0%

|

9.5%

|

|

North West China

|

11.6%

|

2.0%

|

|

South West China

|

0.0%

|

5.0%

|

|

Total up

|

100%

|

100%

|

|

① represents the proportion in total output in domestic; ② represents the proportion in total consumption in domestic.

|

||

According to indication of table 5, the main demand of polypropylene is mainly concentrated in East China, North China and South China, and it is predicted that till 2012 most growth of demand of polypropylene is in East China and North China. In addition, in the next few years, the polypropylene demand in North East China and South West China shall also be rapidly increased.

Table 5: Distribution of polypropylene demand for each region of China in 2004-2012(%)

|

Region

|

2004

|

2006

|

2008

|

2010

|

2012

|

|

East China

|

40.0

|

41.4

|

40.3

|

36.9

|

39.2

|

|

South China

|

24.6

|

20.9

|

20.3

|

19.4

|

18.6

|

|

North China

|

23.4

|

25.0

|

23.8

|

23.5

|

23.3

|

|

North East China

|

5.8

|

6.4

|

8.9

|

10.2

|

10.8

|

|

North West China

|

2.2

|

2.1

|

1.9

|

2.0

|

2.1

|

|

South West China

|

4.0

|

4.0

|

4.8

|

5.3

|

5.9

|

|

Total up

|

100

|

100

|

100

|

100

|

100

|

2.2.2 Demand of terminal product to polypropylene

The product with feedstock of polypropylene mainly consists of pipe material, membrane, woven bag, packing material, vessel, daily plastic product, non-wovens, automobile, household appliance, etc.

In 2008, the polypropylene resin consumption for production of woven bag is biggest, accounting for 31.7% of the total consumption, the consumption proportion for membrane and daily plastic product is respectively 20.1% and 13.2%. The growth for demand of transparent polypropylene and the demand from downstream pipe material, auto and household appliance is very rapid. The downstream consumption structure is in the process of change. The demand of polypropylene for these three downstream industries with fastest development speed was 13.8% in 2004, 17.4% in 2008, and it is predicted that in 2012 it shall be nearly 20%.

3 Conclusion

According to above analysis it can be seen that, as the biggest polypropylene demand market in the world, China draws the attention of international petrochemical tycoons. The tycoons of western countries combined with the oil production big powers in Middle East to start a new circle of capacity expansion course, with China as the major target market. These enterprises rely on advanced production technology, scientific management process, and low cost production feedstock as well as the large scale production plant and their purpose is to have the overall competition advantage. The petrochemical enterprises of Middle East started to set agency offices in Beijing and Shanghai, and established the feedstock encapsulation factories, and their speed for going into China market is faster and faster. China’s polypropylene shall face a thunderstorm attack. The petrochemical enterprises in domestic shall optimize the product structure of polypropylene, enhance the development strength of special product, and positively cooperate with the intermediate merchants with good credit and powerful capital to jointly develop the downstream market. Furthermore, they shall establish the strategic cooperation partner relation with the large factories of downstream to fight the challenge in the future. The domestic petrochemical enterprises in face of domestic polypropylene market with severe competition shall be greatly impacted by the large scale capacity expansion of petrochemical enterprises of Middle East. How to survive and develop in the competition shall be a big challenge for each petrochemical enterprise. In the meeting of “speed up the transformation and development mode, and boost the scientific development enterprise”, Mr. Jiang Jiemin, the president and secretary of Party Branch of PetroChina, emphasized that: “upon the new situation and new task, in order to realize the new target and new development, the strategic thinking, innovation thinking, argumentation thinking must be enhanced with all factors taking into account for coordinated development. The key is to dispose the relation between domestic business and international business, the relation between oil and gas core business and service support business, the relation between scale speed and quality efficiency, the relation between hard force and soft force of the enterprise, the relation between enterprise and various stakeholders. Therefore, a systematic marketing strategy and planning is required to generally improve the force and face the challenge. The theory is combined with the actual situation, the scientific tool and means are used to gradually innovate the marketing means. For example, the price prediction model is used to judge the market price trending and master the sales rhythm, the logistics optimization model is used to lower the logistics operation cost, etc. Furthermore, the production innovation shall be promoted to improve the proportion of dedicated material, promote the reasonable structure of product. The technical service level shall be improved to do well service of product, through the service the difference demand of customer shall be known about, and new demand be discovered. Establish the strategic partner relation with the large scale terminal factory, and the excellent intermediate merchants shall also be trained. The market demand is the orientation, the win-win with customer is the target, and the orientation strategy is that the demand shall be created through the marketing service. ”